💵Property is power: Should you REFINANCE or SELL?🏘️

🎶💃Should I stay or should I go??? 🕺🎶

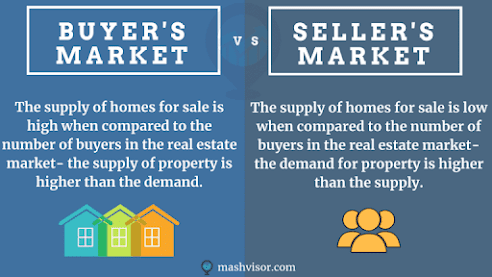

Heading into 2022, housing market experts are

predicting a year of continued high demand and rising home prices. After a

hectic year with many eager buyers and few homes on the market, the housing

shortage will likely continue, though ease eventually. Buyers are still eager

to move, but the low supply of homes on the market in many parts of Canada is

contributing to rising home prices. As a result, it remains a seller’s market

that benefits homeowners who are choosing to sell now.

If you're on the fence about selling, you have a few

choices: You can put your house up for sale soon to take advantage of

the current demand, you can wait to see how interest rates and inflation play

out as they relate to housing (though it could result in a missed opportunity),

or you can opt to stay in your current home for the foreseeable future.

Here are four reasons you should sell your home in 2022,

along with four reasons you may benefit from waiting:

- Sell

in 2022: Interest rates are expected to rise but remain fairly

low.

- Sell

in 2022: You're ready to take advantage of buyer demand.

- Sell in 2022: You need to move.

- Sell in 2022: Your current home no longer suits you long term goals.

- Wait

to sell: You’re worried about affording your next purchase.

- Wait

to sell: You're worried about finding your next home.

- Wait to sell: You love your house and location

- Wait to sell: *The costs to sell do not out weight the costs to buy

-Property transfer tax on purchase (1% on first $200,000 and 2% on balance)

-legal fees on purchase and sale $2500 approx.

-realtor fees for sale (average 6% on first $100,000 2.5% on balance)

-mortgage payout

-penalty

-debt pay out

-down payment 5% on first $500,000 10% on balance up to 1 million dollar purchase price. 20% down on purchase over 1million as minimum (some lenders have a sliding scale which could result in as much as 20% down on first 1 million an 40% on remaining amount.

With rates at an all time low and property values at an all time high, if you aren't ready to sell you can still take advantage of this market and pay off high interest debt or consider suing equity to do renovation and make your home your true dream home!

Sell in 2022: Interest Rates Are Expected to Rise, But

Remain Fairly Low

While mortgage interest rates have remained in the

historically low range for years now – and have more than once set record lows

during the COVID-19 pandemic – they are likely to climb at least somewhat in

2022. While this may seem like a negative for home sellers, rates are still

expected to remain low compared to previous decades and begin the New Year low

as well. Even with higher interest rates possible in 2022, they will likely

remain low from a historical perspective.

While the low rates are promising for an affordable

mortgage, there are not enough properties on the market compared to the number

of buyers who are shopping for a home. Expect rising home prices to balance out

low rates, at least in part. While this could stifle some buyer activity,

there’s enough demand that home sellers should be able to benefit from the

limited supply. Right now, there’s such a large pool of buyers, even if they do

get discouraged (and) choose to pull out of the market, it will still be a very

active market.

Sell in 2022: You're Ready to Take Advantage of Buyer

Demand

Especially if you live in a place where home prices are

climbing fast and bidding wars are common, homes are likely to see plenty of

buyer activity well into 2022, especially at entry-level prices – often

purchased by first-time homebuyers.

The price range that’s considered entry level depends on where you live – typically it's considered the lower third of home sale prices for an area.

Sell in 2022: You Need to Move

If you need to move for any reason, it’s still

possible to sell your home and find a new one. If you lost your job, you may be

worried about your ability to continue to pay your mortgage. If that’s the case,

selling may be a valid option. But plenty of others are opting for a life

change that involves moving to another province or city, more room for a growing family or

a bigger footprint needed for permanent work-from-home space.

If you’re in a market seeing fast home sales, the lack of

inventory can help your home sell, especially if your property falls under the

local entry-level price range.

Wait to Sell: You Just Refinanced

If you’re one of the many homeowners who have refinanced

recently, there’s no reason to consider selling your home in the immediate

future. Hopefully, your refinanced mortgage has helped ease financial woes by

lowering your monthly payments.

Since the start of the pandemic, many homeowners have been

able to lock into mortgage rates below 3%, which makes selling any time in the

near future far less attractive.

If you haven't considered it yet, refinancing can

be a valid alternative to selling your home while rates remain low. Especially

if you're not seeing the right home for you on the market, it’s OK to be picky.

Wait to Sell: You’re Worried About Affording Your Next

Purchase

Earlier in the pandemic, concerns about affording a future

purchase were more likely to be steeped in employment instability – pay cuts,

layoffs and furloughs were happening frequently across Canada as businesses

struggled to adapt to the economic impact of the global health crisis.

Now, however, if you’re worried about affording your next

home purchase it’s more likely tied to the housing market’s quickly rising

prices, lack of new homes for sale or potential lack of equity in your home.

Don’t be afraid to wait to sell your home if you think the timing isn’t right.

There’s no reason to fret about what could happen in the

future – prices could level off in future years and real estate naturally goes

through cycles, but buyers, mortgage lenders and builders are making smart

decisions so far in planning for a stable future.

Wait to Sell: You're Worried About Finding Your Next Home

The caveat of a strong seller’s market is that as

a home seller, you may struggle to find a new home to buy. It might discourage

an existing homeowner from selling knowing that there might not be that much to

buy. You could expand your search to include new construction homes,

though supply chain issues, labor shortages and red tape surrounding zoning and

permits are keeping development slow. Consider having a clause to find a home as part of you accepting an offer on your property, this gives you much needed peace of mind.

Waiting for a more balanced market is a good idea for some

homeowners, and it's unlikely to hinder your ability to get a good price for

the house you sell. In a market where supply and demand are more balanced,

you’re less likely to see multiple offers and sale prices well above the asking

price, but you'll still see positive home value growth

At the end of the day a the most important question to as

your self is:

Is the home you’re in your dream home?

A real estate agent and interior designer walk into a house…

(insert punchline here). While one tries to convince you to stay and

renovate the other guides you through suitable houses available on the

market to convince you to sell. So, should you stay and renovate or sell your

house?

It’s on TV so is it real?

This is the concept behind a popular property TV show, but

it’s not real life. Making the decision to move or renovate is not a

light-weight discussion. Pros and cons push and pull at your sense of reason,

not to mention your bank account. Then once you make up your mind the real

stress sets in because either way you choose your lives will be disrupted.

What does the market tell us?

When we see changes in the market and the value of our homes

start to skyrocket, it’s hard NOT to think about selling. The sentiment goes

out the window as we see dollar signs and the house becomes a building, real

estate, rather than just “home”. Once you’re in the mindset that your house is

a commodity that can be sold or purchased, the sentiment of staying fades away.

Should you sell your house?

It’s important to know what homes in your neighborhood are

selling for today and talk to a real estate agent to learn whether your home

can fetch those prime dollars. Then think about why you’re moving and what

you’re looking for. Is it a bigger home, a better location? What would it cost

to move to a different neighborhood? Your home could be worth more money, but

what can you buy with the proceeds of your sale?

When market values increase, should you just ride the wave

and do nothing to increase the value of your home? Or is this the right time to

invest in your own property?

Should you stay and renovate?

Whether it’s an addition, a full gut job, and re-build, or a

room reno the outcome must address their needs. That’s why it’s a big

discussion at the start. It’s imperative that we know in advance what the

outcome has to be. Sometimes a renovation may not be the answer. You’ll want to

know that before the walls come down.

Before: The balcony and doors were added to the bedroom

wall. It was missing a great view (see above!).

Talk to the experts about your house.

As your investment (your home) increases in value, consider

that for every decade you are in it, you will probably have gone through at

least one or two major life events and your home may need to adjust with the

changes. Not just replacing a carpet but replacing a whole bathroom or kitchen,

adding another story, or an addition.

The dollars you invest back into your home should make sense

to the neighborhood house values. If you’re continuing to stay don’t worry

about future buyers, it’s more important that your home fit YOUR needs.

Talk to the design and real estate pros before you make a life-changing decision to make sure there is a balance between the business side of home ownership and the sentimental side. Don’t wait for them to show up at your door, it won’t happen, except on TV! (And of course, remember ONLY YOU can decide what’s the best option for you and your needs!)

Comments

Post a Comment